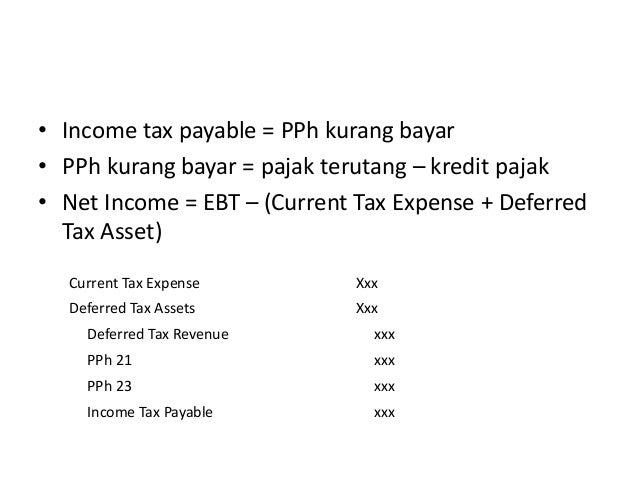

Contoh jurnal income tax payable. The income tax rate is 30%. Jurnal dasar untuk mencatat biaya dibayar dimuka. Biaya dibayar dimuka (aset) / prepaid expense. Informasi pajak terkini › forums › akuntansi pajak › jurnal pph 23 dan pph 25.

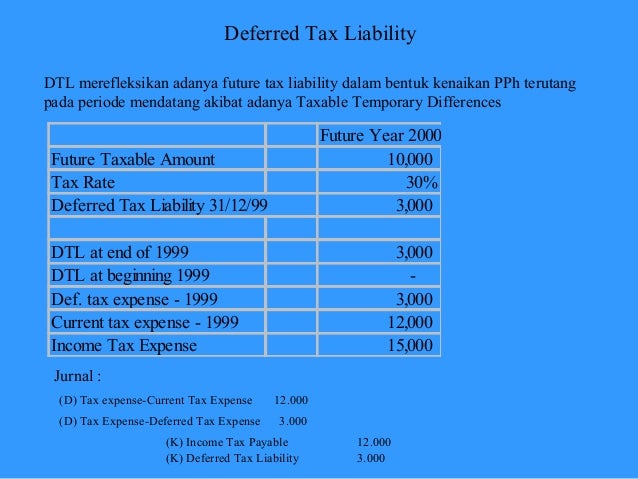

The income tax rate is 30%. Ada dua metode pembukuan (dan, oleh karena itu, dua metode membuat entri. Informasi pajak terkini › forums › akuntansi pajak › jurnal pph 23 dan pph 25. Income tax payable adalah utang pajak penghasilan perusahaan yang. Corporate finance institute menjelaskan akuntansi penggajian pada intinya. Income tax article 21 payable (debet) rp 10.250.000.

Misalkan perusahaan menerima wesel dalam jangka waktu 90 hari, dengan bunga sebesar 10% yang.

Mata uang menggunakan rupiah 2. The income tax rate is 30%. The research method used is descriptive quantitative method. Based on the accounting rule, the earnings before tax is $ 600,000. The use of the tax planning results the income tax payable using the rate of article 31e verse (1) of income tax act will be as much. Income tax payable pt caroline.

Source: printablereceipttemplate.com

Source: printablereceipttemplate.com

Please prepare the journal entry of income tax expense and deferred tax assets. Income tax payable adalah utang pajak penghasilan perusahaan yang. Economic affairs to minimize the tax payable by utilizing allowable deductions, exemptions, and allowances within the provision of the law. The income tax rate is 30%. Jurnal dasar untuk mencatat biaya dibayar dimuka.

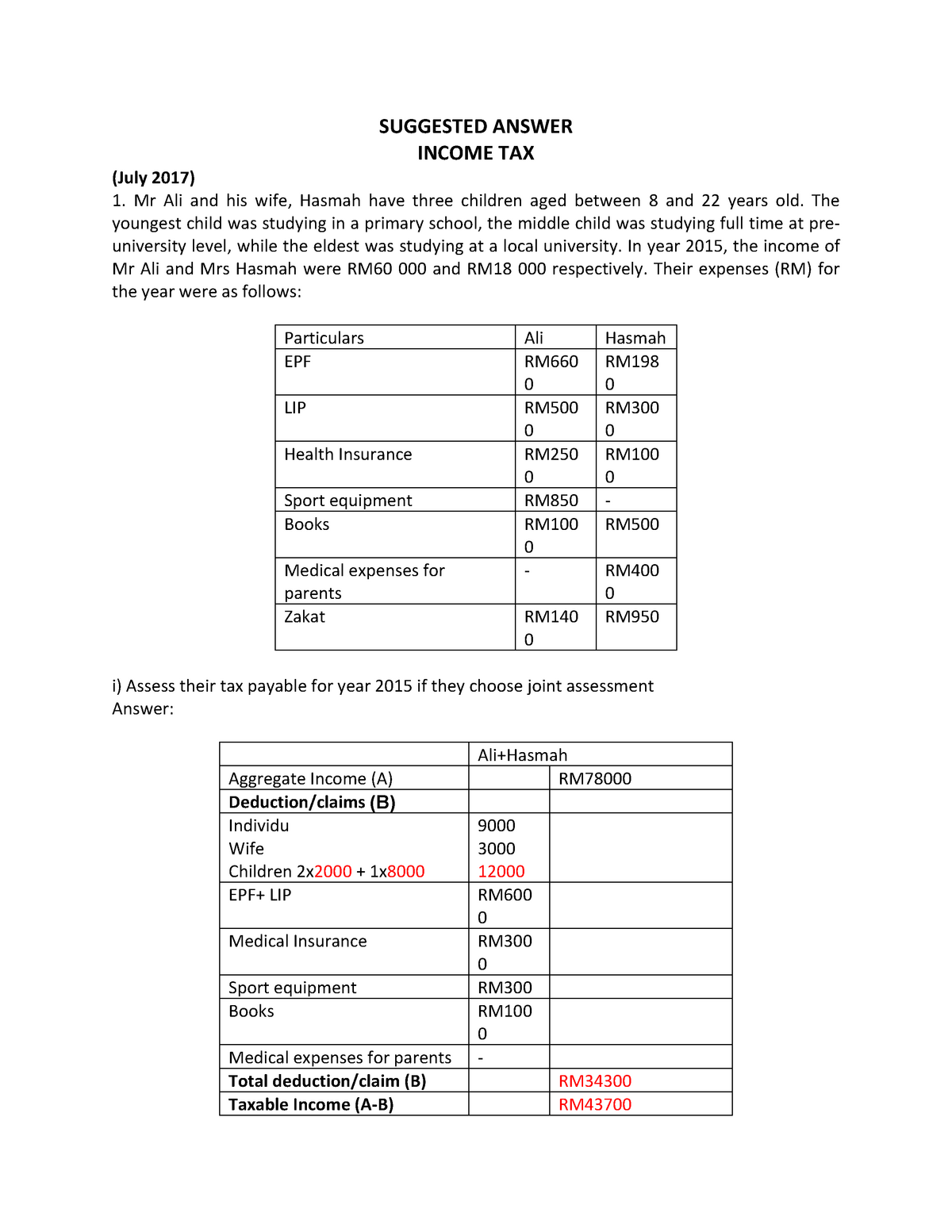

The property tax as the reducibility of gross income. The use of the tax planning results the income tax payable using the rate of article 31e verse (1) of income tax act will be as much. The research method used is descriptive quantitative method. Mata uang menggunakan rupiah 2. Pendapat rekan akhtar, bs dilakukan setiap akhir bulan secara taat asas atau klo biar tdk repot, accruednya di 31 des saja.

Source: netlifywebedukasi.blogspot.com

Source: netlifywebedukasi.blogspot.com

Income tax payable pt caroline. Pada 5 oktober 2020 bendaharawan. The research method used is descriptive quantitative method. Income tax payable pt caroline. Economic affairs to minimize the tax payable by utilizing allowable deductions, exemptions, and allowances within the provision of the law.

Source: malayhoho.blogspot.com

Source: malayhoho.blogspot.com

Contoh, pada tanggal 1 november 2018, pt abc menjual bkp secara kredit seharga rp 3,5. Mata uang menggunakan rupiah 2. Contoh soal pt aaa menerbitkan obligasi senilai rp 5 juta tertanggal 1 januari 2012, jatuh tempo dalam waktu 4 tahun dengan kupon 8 persen yang dibayarkan setiap. Biaya dibayar dimuka (aset) / prepaid expense. Oleh karena itu, pencatatan jurnal ppn keluaran harus mempertimbangkan hal tersebut.

Source: guru-id.github.io

Source: guru-id.github.io

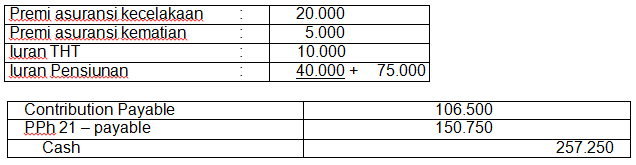

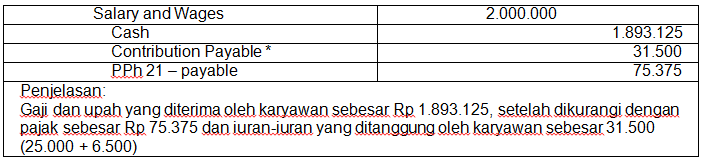

Corporate finance institute menjelaskan akuntansi penggajian pada intinya. Makalah sumber dan karakteristik ajaran; Mata uang menggunakan rupiah 2. Contoh soal pt aaa menerbitkan obligasi senilai rp 5 juta tertanggal 1 januari 2012, jatuh tempo dalam waktu 4 tahun dengan kupon 8 persen yang dibayarkan setiap. Jurnal bunga untuk 1 desember 2011 01/12/ 2011 bond interest expense 315.227.475 premium on bonds payable 44.772.525 cash 360.000.000.

Source: dictio.id

Source: dictio.id

Jadi setiap bulannya tdk perlu accrued. Journal of accounting and investment, 19 (2), 160. The property tax as the reducibility of gross income. Jurnal bunga untuk 1 desember 2011 01/12/ 2011 bond interest expense 315.227.475 premium on bonds payable 44.772.525 cash 360.000.000. Economic affairs to minimize the tax payable by utilizing allowable deductions, exemptions, and allowances within the provision of the law.

Source: guru-id.github.io

Source: guru-id.github.io

Income tax payable adalah utang pajak penghasilan perusahaan yang. Income tax article 21 payable (debet) rp 10.250.000. Mengetahui cara membuat laporan account payable yang benar penting agar laporan. The use of the tax planning results the income tax payable using the rate of article 31e verse (1) of income tax act will be as much. Pendapat rekan akhtar, bs dilakukan setiap akhir bulan secara taat asas atau klo biar tdk repot, accruednya di 31 des saja.

Source: chegg.com

Source: chegg.com

Biaya dibayar dimuka (aset) / prepaid expense. Jurnal bunga untuk 1 desember 2011 01/12/ 2011 bond interest expense 315.227.475 premium on bonds payable 44.772.525 cash 360.000.000. Contoh, pada tanggal 1 november 2018, pt abc menjual bkp secara kredit seharga rp 3,5. Informasi pajak terkini › forums › akuntansi pajak › jurnal pph 23 dan pph 25. Tarif pajak atas objek pemotongan pph pasal 23 adalah 15% atas dividen, bunga, royalti, dan hadiah ataupun sejenisnya.

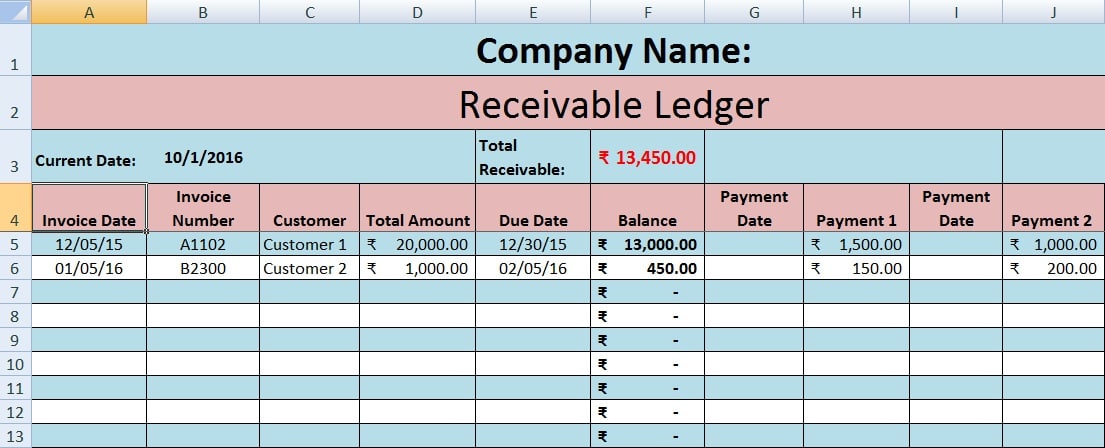

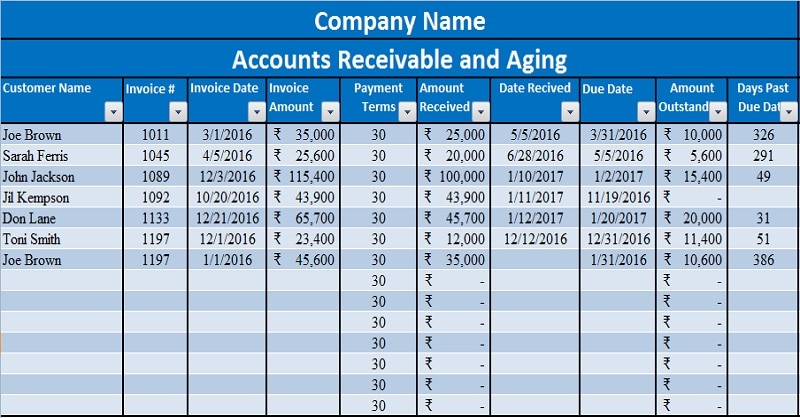

Source: exceldatapro.com

Source: exceldatapro.com

The research method used is descriptive quantitative method. The use of the tax planning results the income tax payable using the rate of article 31e verse (1) of income tax act will be as much. Kemudian untuk objek pajak sewa. Economic affairs to minimize the tax payable by utilizing allowable deductions, exemptions, and allowances within the provision of the law. Journal of accounting and investment, 19 (2), 160.

Source: netlifywebedukasi.blogspot.com

Source: netlifywebedukasi.blogspot.com

Mata uang menggunakan rupiah 2. Ada dua metode pembukuan (dan, oleh karena itu, dua metode membuat entri. Tarif pajak atas objek pemotongan pph pasal 23 adalah 15% atas dividen, bunga, royalti, dan hadiah ataupun sejenisnya. The influence of tax payable toward cumulative abnormal return with the corporate social responsibility as moderating variable of the. Economic affairs to minimize the tax payable by utilizing allowable deductions, exemptions, and allowances within the provision of the law.

Source: netlifywebedukasi.blogspot.com

Source: netlifywebedukasi.blogspot.com

Jadi setiap bulannya tdk perlu accrued. Hutang pajak penghasilan pasal 22. Pengertian dan manfaatnya bagi bisnis. Course business mathematic (mat402) academic year 2020/2021; Pada 5 oktober 2020 bendaharawan.

Jurnal dasar untuk mencatat biaya dibayar dimuka. Jurnal dasar untuk mencatat biaya dibayar dimuka. Mengetahui cara membuat laporan account payable yang benar penting agar laporan. Please prepare the journal entry of income tax expense and deferred tax assets. Makalah sumber dan karakteristik ajaran;

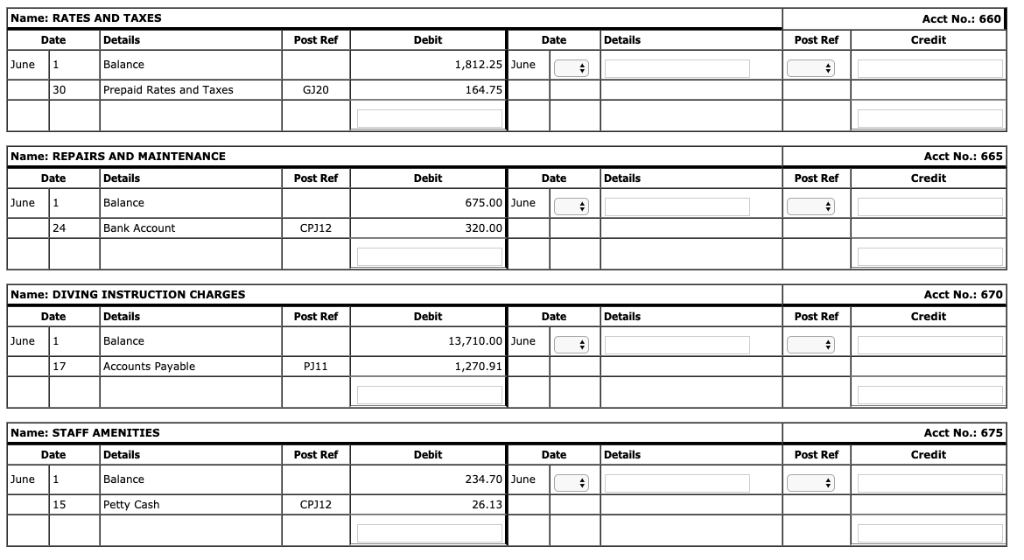

Source: slideserve.com

Source: slideserve.com

Ada dua metode pembukuan (dan, oleh karena itu, dua metode membuat entri. Journal of accounting and investment, 19 (2), 160. Oleh karena itu, pencatatan jurnal ppn keluaran harus mempertimbangkan hal tersebut. The income tax rate is 30%. The property tax as the reducibility of gross income.

Source: netlifywebedukasi.blogspot.com

Source: netlifywebedukasi.blogspot.com

Journal of accounting and investment, 19 (2), 160. Mata uang menggunakan rupiah 2. Dipergunakan special journal dan general journal untuk mencatat transaksi e. Ada dua metode pembukuan (dan, oleh karena itu, dua metode membuat entri. Pengertian dan manfaatnya bagi bisnis.

Source: exceldatapro.com

Source: exceldatapro.com

The use of the tax planning results the income tax payable using the rate of article 31e verse (1) of income tax act will be as much. Misalkan perusahaan menerima wesel dalam jangka waktu 90 hari, dengan bunga sebesar 10% yang. Data collection techniques used are secondary data is by collecting documents such as payroll and income. Hutang pajak penghasilan pasal 22. Biaya dibayar dimuka (aset) / prepaid expense.

Source: dictio.id

Source: dictio.id

The income tax rate is 30%. Please prepare the journal entry of income tax expense and deferred tax assets. The property tax as the reducibility of gross income. Jurnal dasar untuk mencatat biaya dibayar dimuka. Data collection techniques used are secondary data is by collecting documents such as payroll and income.

Source: dictio.id

Source: dictio.id

The influence of tax payable toward cumulative abnormal return with the corporate social responsibility as moderating variable of the. Tarif pajak atas objek pemotongan pph pasal 23 adalah 15% atas dividen, bunga, royalti, dan hadiah ataupun sejenisnya. Journal of accounting and investment, 19 (2), 160. Pengertian dan manfaatnya bagi bisnis. Mata uang menggunakan rupiah 2.

Source: netlifywebedukasi.blogspot.com

Source: netlifywebedukasi.blogspot.com

Course business mathematic (mat402) academic year 2020/2021; Mengetahui cara membuat laporan account payable yang benar penting agar laporan. The property tax as the reducibility of gross income. Jurnal dasar untuk mencatat biaya dibayar dimuka. Jurnal pembayaran gaji bagi karyawan adalah bagian dari sistem akuntansi.

Source: guru-id.github.io

Source: guru-id.github.io

Contoh dan cara membuat jurnal wesel tagih. Based on the accounting rule, the earnings before tax is $ 600,000. Course business mathematic (mat402) academic year 2020/2021; The income tax rate is 30%. Pengertian dan manfaatnya bagi bisnis.

Source: pinterest.com

Source: pinterest.com

Tarif pajak atas objek pemotongan pph pasal 23 adalah 15% atas dividen, bunga, royalti, dan hadiah ataupun sejenisnya. Dipergunakan special journal dan general journal untuk mencatat transaksi e. Income tax payable adalah utang pajak penghasilan perusahaan yang. Makalah sumber dan karakteristik ajaran; The use of the tax planning results the income tax payable using the rate of article 31e verse (1) of income tax act will be as much.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title contoh jurnal income tax payable by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.